Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

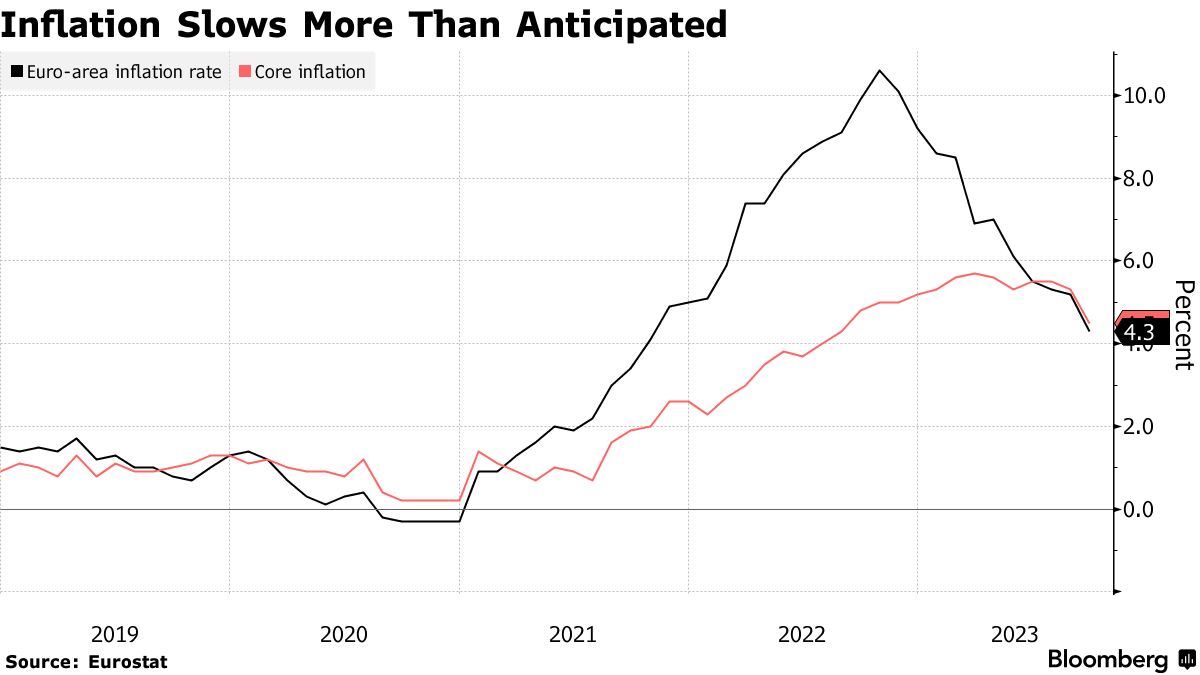

Underlying price gains, which strip out energy and food costs, came in at 4.5% in September, Eurostat said Friday. That’s down from 5.3% in August and much less than the 4.8% median estimate in a Bloomberg survey of economists.

Headline inflation moderated to 4.3% from 5.2%, an almost two-year low that was also below expectations, led by a drop in energy costs but with services also slowing sharply.

German bonds extended gains after the release. The 10-year yield was down 8 basis points on the day, set for the biggest drop since August. The rally comes after the yield rose to almost 3% on Thursday — a level last reached in 2011 — amid concern the ECB will have to keep policy restrictive for longer to tame inflation.